Non-state pension fund of electric power industry (non-profit organization): feedback

Today the attention of readers will be presentedNon-state pension fund of electric power industry. What is this organization? What are its pros and cons? What place does it occupy in the rating of the country's APF? To understand all this will help many reviews. They contribute to the formation of an approximate opinion on certain NPFs. What can this organization offer?

About activity

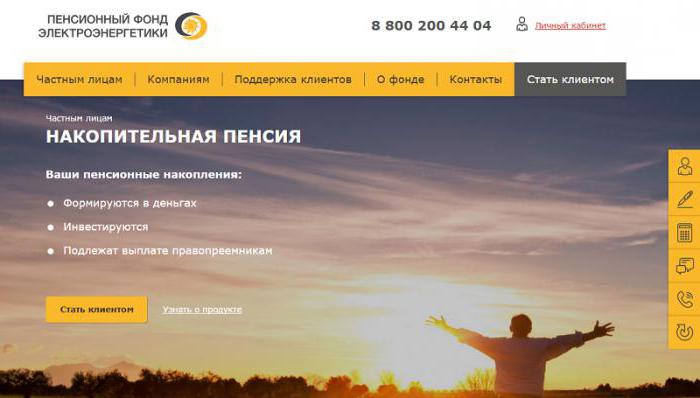

Non-state pension fundelectric power industry is nothing more than a company that offers pension insurance for the population. It will help to save the savings made for old age. It also serves to form the funded part of the pension.

For its activities this fund receivespositive reviews. There is no deceit, everything is very clear: it is the most common non-state fund that offers pension insurance services. But what are the advantages and disadvantages of the company still worth paying attention to?

Distribution by country

Now in Russia the situation with pension fundsThe non-state type is that many of them are closed. They simply take away their licenses. Usually, such incidents involve either small organizations or unscrupulous companies.

What about the corporation being studied? The NPF of the electric power industry is a very large fund, which has been operating in Russia for a long time. The first branch of the company appeared in 1994. And since then the organization has been quite successfully engaged in population insurance.

The fund is distributed throughout Russia.Branches can be found in every city, even in the smallest locality of the country. Therefore, many potential customers trust the management of the organization. There is every reason to believe that this is not about scammers. The pension fund will obviously not close suddenly. Therefore, it is possible to entrust pension accumulation to the named APF.

Head Office Address

And where is the head office of the organization? At the next address you will find the Non-State Pension Fund of the Electric Power Industry: Moscow, Timur Frunze Street, Building 11, Building 13.

It is here that every citizen can turn toPension fund on global issues. Finding an organization is not very difficult. In addition, there is a hotline phone that will help you easily get advice on providing pension insurance services. All questions will be answered.

To reach the APF, you can dial the number8-800-200-44-04. Many note that the non-state pension fund of the electric power industry is not 100% fraudulent. After all, on the official website of the organization you can see the location and contacts of all the departments of the fund in this or that city. It is noted that the population trusts this corporation.

Rating

And now a little about the main evaluation criterianon-state pension funds. They play an important role in shaping the general impression of an organization. For example, many potential customers are interested in what NPF power rating is.

This company is among the top 10Pension funds of Russia. Somewhere it is indicated that the given company is closer to the leading positions, in some sources one can see that this is not so. But in any case, clients very often turn to this company and leave positive comments about it.

This means that there is every reason for trust.Usually the top 10 APFs in the country are places that actually help to save pension savings and ensure a good life in old age. Every citizen should know about this.

Despite some ambiguity of data, APFThe electric power industry has a very high rating. And it pleases. It is enough to remember that this is one of the top 10 organizations in Russia that offer pension insurance services to the public.

Confidence

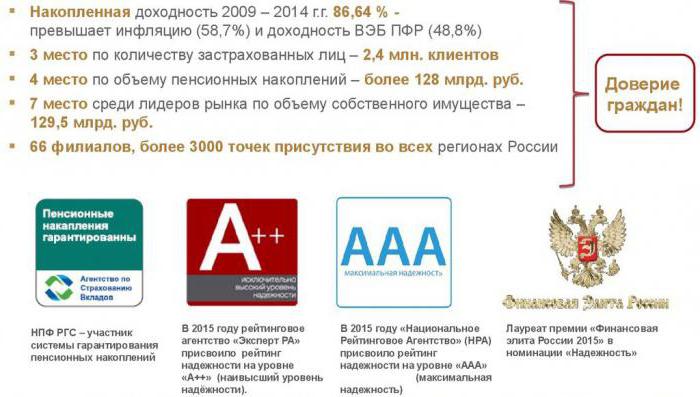

An important point is the so-calledlevel of trust. He indicates how much potential and real customers trust this or that organization, being a kind of indicator of the reliability of the firm.

Non-state pension fundthe electricity industry has a high level of trust. If you believe the statistics, the trust is held at the A ++ mark. Or, as still sometimes indicated, on AAA. This is the highest level of the trust.

It follows that the organization issustainable. You can easily entrust her pension insurance. This is the opinion of many potential and real customers. In any case, if we take into account everything that was said before, we can conclude that the NPF of the electric power industry is a stable, reliable and safe corporation. It will not be closed, the license will not be taken away from it. And this is enough for many to start cooperation.

Profitability

But there is another important point. The fact is that plus non-government pension funds is the so-called profitability. APFs suggest a little increase in available pension savings. And this indicator for many customers is extremely important. Especially if the main task is to increase accumulation, rather than preserve it.

Yield of the NPF of the electric power industry, as they saycustomers are not too high. But it is higher than many competitors offer. The reviews do not provide any significant picture that would allow us to assess the real return on deposits. Why?

Many people are dissatisfied with the cooperationprecisely because of profitability. Initially, customers are offered a high level of return - about 12-15% per annum. But in practice OAO NPF Electricity provides only about 5-7% of profitability. Many people do not like this difference. Therefore, some directly declare that they feel cheated.

In fact, this phenomenon is easily explainedinflation. Also it is worth paying attention to the fact that similar discrepancies between the real and the promised profitability are for all non-state pension funds. To be surprised it is not necessary. Nobody will deceive future retirees. The actions of the Electric Power Fund are absolutely legitimate and fair.

Service

And what do they say about the service? It is also difficult to find a common opinion. The quality of customer service is different. Much depends on the city in which the cooperation takes place. Everywhere their employees, all behave differently.

Pleases that you can not only personally contactNon-state pension fund of electric power industry. "Personal office" is an opportunity that attracts many people. This is the way to work with the Pension Fund online.

This function works, as many people notice, withsome failures. But not too critical. If you want, you can easily ask a consultant directly through the Internet. Also, "Personal Cabinet" allows you to easily manage your account and order statements from it.

At personal visit to offices visitors, asrule, also try to give proper attention. And it pleases. Nevertheless, the non-state pension fund of the electric power industry makes ambiguous responses for customer service.

On the one hand, everyone is paying attention. And they answer the questions asked by visitors. On the other hand, the speed of service leaves much to be desired. Sometimes consultants do not answer questions, but only confuse customers. Fortunately, there are not so many such complaints. There are no significant complaints about servicing, but the NPFs have deficiencies in this area.

Conclusion of the contract

Particular attention is paid to this factor,as the conclusion of the contract. Despite the fact that the Electric Power Fund is among the top ten leaders in pension insurance organizations, some negative aspects of cooperation are still underlined by the population. More precisely, we are talking about small shortcomings. They come up mostly at the conclusion of contracts.

The fact is that some point toThe impossibility of cooperation with the company, if a person already has 43 years. It is this age that is emphasized. Visitors assure that after the specified restriction in the conclusion of the contract they refuse.

The agreement is made in two copies, which pleases. Basically all the conditions are clear, but some points can raise questions. They will quickly respond to employees.

There are no more significant complaints. If necessary, you can terminate the contract with the APF at any time. And the money is transferred to another organization. Cash before retirement is not issued here. And this condition is spelled out in the contract. It is worth paying attention to. Some clients notice that it is necessary to look at the losses that are incurred when the contract is terminated before the end of this or that year. Otherwise you might think that the non-state pension fund of the electric power industry works in bad faith and appropriates the money of depositors.

Payments

The final nuance, which we recommend to pay attention to, is the payment of pension savings. This question raises doubts about the company. Why?

Non-state pension fundelectric power industry (Moscow, Frunze St., Building 11, Building 13 - the address of the head office of the corporation), payments are made, but with some delays. That's why you can see mixed comments about the company's work. Some say that they do not pay pensions. At the same time, some clients claim the opposite. So who do you trust?

Everyone. As already mentioned, payments are made, but quite often there are various delays. And it just needs to be ready. Pensioners still get what they need. Even if not on time. NPF is trying to establish work in this area. But he does not intend to deceive his clients.

Outcomes

What conclusions can be drawn? It is clear what the Pension Fund of the electric power industry is. This is a company that is large and widespread in Russia. It has been performing its functions for a long time. Offers a good return. But, most importantly, stability and reliability.

Many point out that if you want to receivehigh return on deposits, do not pay attention to a non-state fund. But when the priority is the stability and retention of the pension, then we should consider the organization as a possible place to conclude a contract for pension insurance.