"European" pension fund: basic performance indicators

In Russia, since 2002, citizens born in 1967year and later, the pension is formed from two components: insurance and funded. The first part (insurance) gives the right to a pension after reaching the retirement age, while the same money withheld from the income goes to pay for current pensioners. This is the prerogative of the Pension Fund of the Russian Federation (PF). In the second - the accumulated money belongs exclusively to the person who deducts them. Here you can create capital both through the state pension fund and through the non-state pension fund (NPF), for which it is necessary to conclude an appropriate contract.

Here is just a wide field of activity (after allNPF a lot) and a great responsibility (this is your future pension). Experts can help, and it would be nice to take an interest, for example, by ratings of APFs, the history of a particular fund on the market, and to read reviews of citizens.

The Pension Fund "European"

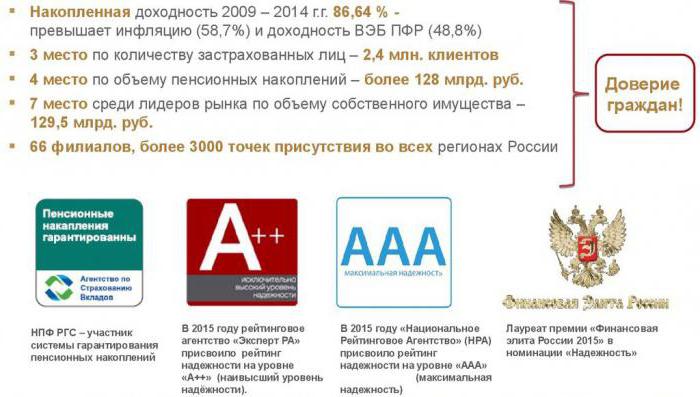

Non-state pension fund "European"was founded in 1994. He has work experience and offers European service. According to the Russian agency "Expert RA", its rating is "A +", which means "very high level of reliability". He is a member of the National Association of Non-State Pension Funds and is a member of the American Chamber of Commerce. The range of services is great. This is the management of pension savings, and pension plans (individual and corporate), life insurance and investment products. The Pension Fund "European" has opened representative offices in more than 50 cities of Russia.

Ratings

| Indicators | Place in the rating | Number of participants in the rating |

| by profitability from investment of savings | 2 | 84 |

| by number of insured persons | 20 | 95 |

| by the amount of pension savings | 18 | 95 |

| by number of participants | 56 | 126 |

| by the number of people who already receive a pension | 79 | 120 |

It is also important to increase the indicators within a specificfund for several years. The Pension Fund "European" for the last 2 years has increased pension and insurance reserves, provisions for coverage of liabilities, income from placed pension reserves.

Reviews

Opinions of people, fund participants, to some extentcan also help determine. Although you need to understand that this is a subjective assessment of a person, and it depends on the level of his knowledge, attitude to himself or others and even, say, the weather. No exception - the "European pension fund". Feedback is both positive and negative. It's quite normal. The main thing is that today people have an alternative.

They have the right to decide where to accumulate funds. Competition encourages market participants to improve and be attentive to their customers.