How to fill in personal income tax? 3-NDFL: sample filling. Example 3-NDFL

Many citizens are faced with the question,how to fill in personal income tax 3 forms. In fact, everything is quite simple, you can do it yourself and for free. In this publication there are recommendations that will help understand the answer to the question posed. The most important thing is to carefully read and observe them.

What is the purpose of the declaration and who should fill it in?

Tax declaration NDFL-3 - a document necessary for the individual's report to the state on the income received. It consists of 26 sheets that fill:

- individual entrepreneurs;

- notaries, lawyers and other persons engaged in private practice;

- citizens who received an inheritance;

- winning lottery or other risk-based game;

- people who receive income from those who are not a tax agent (landlords);

- who received a profit for which the tax was not paid.

The program for filling 3-NDFL

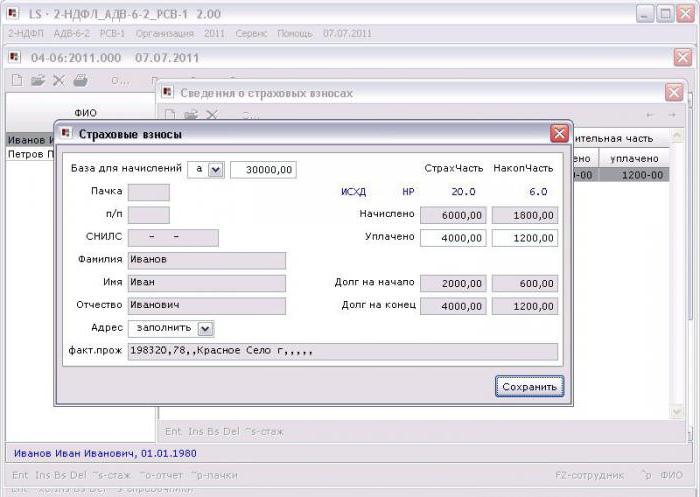

The document in question is the easiest to issue athelp of the free utility "Declaration-2013", which you can download from the site of the Federal Tax Service. Next, you need to install it on a personal computer.

The functionality of the program allowsenter information about taxpayers, calculate the final indicators, check the correctness of the calculation of deductions, benefits, and generate a file in XML format. For the full work of the "Declaration-2013" program, minimal system requirements are required.

If a person knows the form of 3-NDFL, the program, how to fill in it all the fields, taking into account all the features, he quickly and correctly draw up the document.

"Declaration 2013". Part 1: filling in information about the taxpayer

First you need to run the program(a shortcut on the desktop with a green letter D). In the window that appears, select the "Condition" entry in the left panel. Now the reader will learn how to fill in personal income tax with the help of the "Declaration-2013" program.

If the taxpayer is a resident (stayedin Russia more than six months), choose the type of document "3-NDFL", otherwise - "3-NDFL non-resident". In the field "General Information" a tax inspection code is entered into which information will be provided. Since the document in question is provided at the place of permanent residence registration, residents of the regional center do not fill the "Area" field.

Taxpayers wishing to understand how to fill outNDFL-3, and for the first time declaring a declaration for the year, the "correction number" section is left zero. Otherwise, put a unit (you need to clarify the early declaration). In the item "Taxpayer Sign", a choice is made of who the person is. Further in the menu "There are incomes" it is necessary to put a tick there where the profit comes from.

"Declaration 2013". Part 2: Who submits the declaration?

The program needs to clarify the reliabilitydelivery of documentation: either the person submits it for himself (mark "personally"), or for another individual ("Representative FL"), or he is the representative of the organization. If the formalities in question are performed in lieu of another citizen, you will need to enter personal data and a document number that can be:

- power of attorney from a legal or physical person;

- a birth certificate if the representative is the parent of the child.

Now you need to click the "Save" button on the top toolbar to save all the data. The name of the declaration is entered in the appeared window.

"Declaration 2013". Part 3: information about the declarant

On the left sidebar there is a tab "Detailsabout the declarant ". Under the button, where the information is stored, there is a button with an image resembling a cabinet with an open box. When you click on it, you will need to fill in personal information: TIN (you can find out on the FTS website, but you do not need to fill in this field), passport data, and save your changes.

The next step is to click on theprevious button in the form of a house. In the opened panel the type of residence (permanent or temporary), address, phone number and OKATO (the all-Russian classifier of administrative-territorial division) is indicated.

"Declaration 2013". Part 4: Information on Income and Expenses

Entrepreneurs and individuals who wishunderstand how to fill in personal income tax (3 form), must correctly enter information about the income received. To do this, you need a personal income tax certificate of the 2nd form, which you can obtain from the organization at the place of work that withholds income tax. Different types of profits are subject to the corresponding tax rates. For example, salary - 13%, material benefit - 35%, dividends - 9%. Each method of obtaining a profit has a unique code: 2000 - wages, 2012 - funds for leave, 2010 - income under GPC contracts, 2,300 - sick leave, 1,400 - rental income, 2,720 - gifts. When you calculate personal income tax, you should take into account the deductions (benefits not taxable) in the form of codes that can be viewed in the certificate. On the basis of all these data, we continue to understand how to fill out a certificate of 3-NDFL.

Step 1. In the left panel, select the item "Incomes received in the RF".

Step 2. Under the button "Save" you should select the number 13, which means the tax rate. If the declaration is filled in connection with the sale of property that is in possession of less than three years, then only information on the profit from this operation is indicated.

Step 3. In the section "Source of payments" with green plus sign, you should add as many organizations as personal income tax certificates and fill in the required data: TIN, CAT, OKATO. For a company that provides standard deductions, tick off the appropriate inscription.

Step 4. In the "Sources of payment", which are under the previous paragraph, they enter information about the income. To do this, click the plus sign to add and minus to delete.

Step 5. Fill in the "Total amounts by source of payment" field (section 5 of the help).

Step 6. If in clause 5.7 of the NDFL of the 2nd form the amount is indicated (the tax agent did not withhold the entire amount of the income tax), then information on income taxable is entered.

"Declaration 2013". Part 5: filling in the graph with deductions

There are four tabs in this section. Those wishing to receive an answer to the question of how to fill out the 3-NDFL correctly should know that each of them corresponds to a certain category of deductions: standard, property, social and past losses from operations with securities.

Entering the first group, it is necessary to putcheckboxes in the required fields. If the taxpayer has children, then the label "Deduction for the child (children)" should be left. The next field - "Deduction for a child (children) to a single parent" - does not cause any questions. The last field under the question mark means deductions intended for the guardian or single parent whose status has changed during the year. Further information on the number of small family members is specified. Also, the standard deductions are provided by codes 104 and 105.

Button with a red tick - social deductions. To declare them, you should put a mark in the proper place. Young taxpayers wishing to understand how to fill out the form of 3-NDFL (social deductions), should know that the deductions are limited.

If necessary, the field "Propertytax deduction for construction ", which will require information from documents for the acquisition of property. After that press the button "Go to the input of sums". That's all you need to do to fill out the declaration using a computer program.

Preparation of documents

View the result in the program"Declaration 2013" can be done using the "view" button. Then make a one-sided seal in two copies. It remains neatly to fasten the sheets with a stapler (so that the staples do not block the barcode), put the date in the format February 24, 2014 and sign. On the front page, indicate the number of completed sheets and attached documents.

Tip: all documents should be brought to the tax service independently. The specialist will verify the duplicates and return some originals, as well as report errors or lack of additional materials. Sending NDFL-3 by e-mail can delay the process with deductions.

3-НДФЛ: a sample of filling for 2014 (title pages)

Sometimes it is not possible to issue a declaration oncomputer. Some people are used to doing this on a ready-made form. Then you may need the presence of "Guarantor", "Consultant" or other system where you can download and print the form of 3-NDFL. A sample of filling for an individual who has received a profit from the sale of an apartment is presented later in the article.

Citizen Belov Andrey Viktorovich (TIN772478888888), who lives in Moscow, in January 2014 sold Ivanova Natalia Olegovna (INN 772499999999) an apartment received in the order of inheritance in 2012. On income from the sale, Andrei Viktorovich is required to provide documentation until April 30, 2015.

To receive a tax deduction for a tax returnit is necessary to attach photocopies of documents confirming the receipt of money by the seller from the buyer (receipt for 1 page), the contract of sale (between AV Belov and NO Ivanova), as well as acts confirming the tenure of ownership of the sold apartment.

On the first page in the field "Number of adjustments"the figure is zero, since the taxpayer for the first time submits a declaration for 2014. In the TIN item, the figures 772478888888 should be indicated. In the section "Tax period" there should be the number 34 and year 2014. In the field "Provided to the tax authority" a tax service code is written. In this case, the number 24 should be indicated (you can see the first four digits in the TIN: 77 - the code of Moscow, and 24 - the number of the agent). The "Taxpayer category code" is then filled in. For A.V. Belova is number 760.

The code for OCTMO, whichit is possible in the tax service. In this example, this is 45315000. Next, write the full name, first name, middle name, phone number, at the bottom, put the date and signature. It is also necessary to indicate the number of completed pages and the attached documentation.

In the "Date of birth" A.V. Belov should write the relevant data in the format 05.08.1982. In the field "Place of birth" is written in Moscow. "Presence of citizenship" - 1 (for persons with citizenship, 2 - without citizenship). In the section "Country code" 643 (Russia) is put. Next, the document code and passport data are indicated. In the "Status of the taxpayer" 1 (resident of the Russian Federation) is put.

Example of a completed 3-NDFL declaration on the profit from the sale of property: other pages

In the section titled "Place of residencetaxpayer "should indicate the address of the permanent place of residence according to the following pattern: 107113 (postal code), 77 (region code), Moscow. Next is written the street, house, building and apartment number.

In sheet A, the amount of income received fromBUT. Ivanovo (2.5 million rubles.). According to the law (Article 220, clause 2.1 of the Tax Code), the tax deduction limit is 1 million rubles, which means that the amount of taxable profit is 2.5 - 1 = 1.5 million rubles. The calculated tax is equal to 1,5х13% = 0,195 million rubles. The results are displayed in the second paragraph.

In section 1.1.1 sheet E should write the total amount of income received - 2.5 million rubles., And in 1.1.2 - the maximum tax deduction - 1 million rubles. The calculation of the fields of sections 1 and 6 is indicated in the declaration, so it does not cause any difficulties.

In this publication, responses tothe following questions: why do I need a tax return, how to fill in 3-NDFL. A sample of filling was also presented, and it was also told how to draw up this document with the help of a special program. Knowing all these features, the taxpayer can choose the most convenient way for him and do all the necessary formalities.