Declaration of 3-NDFL: how to fill in correctly

From time to time in our life there are moments,when we need a declaration of 3-NDFL. How to fill it, not all taxpayers know. Yes, and the fear of something to muddle it discourages to engage in this business. However, all is not so scary. The main thing is to be careful when filling out and not to be nervous. And within the framework of this article, we will try to explain in detail when a declaration of 3-NDFL is needed, how to fill it in and how to simplify this process.

In what cases is a declaration required

The main income of citizens of our country iswage. Tax is levied on it at 13%. Enumerates to the Federal Tax Service his employer. Therefore, ordinary people do not need to fill out anything and do not need to send it anywhere. But there are a number of cases when 3-NDFL is necessary:

- Sale of property (car, apartment, land, etc.), which was in possession of less than three years.

- Receiving wins and gifts from people who are not close relatives.

- Receiving income from entrepreneurial, attorney, notarial, etc. activities.

- Receipt of profit under civil law contracts (for example, renting).

- Receiving a tax deduction.

In what form it is possible to fill and submit 3-NDFL

At the moment there are several optionsfilling out the document. This can be done by hand on special forms. They can be purchased at the Federal Tax Service or printed on a printer. You can independently "fill" the computer, and then print it out. In addition, there is a specialized software that helps in filling out. In this case, it is necessary to enter the initial data, all calculations will be performed by the program itself, and you will have a ready-made 3-NDFL declaration on hand. How to fill is a matter of taste and ability. You can file a document on a personal visit to the tax authority at the place of residence (residence permit), by mail or electronically via TSS (via the Internet). But it should be borne in mind that each case is individual, and any method can be unacceptable. For example, through telecommunication channels of communication it is impossible to send confirming documents to the declaration on a property deduction.

General rules of filling

- When filling, blue or black ink is used.

- If the declaration is output to the printer, only one-sided printing is possible.

- There should be no corrections and strikethroughs.

- When you consolidate and print the declaration, barcodes and all data should not be deformed or lost.

- Each indicator has its own field with a certain number of cells.

- All monetary amounts are indicated in rubles and kopecks, except for the amounts of income in foreign currency before they are converted to the ruble equivalent.

- The amount of tax is indicated in rubles, kopecks are rounded (to 0.5 rubles - to the smaller side, 50 kopecks and more - to the large).

- All fields must be filled from the leftmost cell. One sign is one cell.

- If the value of OKATO (OCTM) is less than 11 digits, zeros are placed in free right cells.

- On each page in the allotted place the TIN, as well as the surname and initials of the taxpayer.

- On each page below, the date and signature of the individual in the corresponding fields are placed.

Required pages

3-NDFL contains the title page, 6 sections, andAlso sheets A, B, B, G (1, 2, 3), D, E, F (1, 2, 3), 3, I. At first glance, there are a lot of them. But in fact, not all of them are needed. The number of pages to fill depends on each situation. The title page and section 6 must be completed. Other pages - if necessary. We do not describe when this or that sheet is needed, because each page of the form is entitled and makes it clear when it should be provided.

Title page

Consider in order all the fields of the title page, consisting of two pages. Both are required.

1. As it was already written above, you must put INN at the top.

2. Next comes the number of the adjustment.If the declaration for the given period is submitted for the first time, this field is set to zero. If some inaccuracies were found during the check, then it is necessary to refill the document. The correction number in this case is the serial number of the clarifying declaration. Ie, for example, if the changes were made only once, put the number "1", if two times - respectively, place a deuce, etc.

3. The next field is "Tax period (code)". 3-NDFL is always submitted at the end of the year, therefore in this field there will always be a code "34".

4. "Reporting tax period".Here is the year for which the declaration is filed. It should be noted that when you receive any income, 3-NDFL must be made no later than April 30 next year. For example, if in 2014 you sold the car, then by the end of April 2015 you must be provided with a 3-NDFL declaration. How do I fill in this field? Here is the year 2014. If you collect documents for obtaining a tax deduction, you can file the declaration at any time during the year, and not only for one, but also for the three previous periods. Accordingly, in 2014 you can submit to the Federal Tax Service 3-NDFL in triplicate - one for each reporting tax period: 2011, 2012, 2013.

5. "Tax Authority" - a four-digit code of the IFNS of your district. It can be found in any branch on the information stands or through reference services.

6. "Taxpayer category code".Basically, there is a number "760", indicating another physical person, declaring their income or claiming a tax deduction. But there may be other options:

- 720 - individual entrepreneur.

- 730 - persons engaged in private practice, incl. notaries.

- 740 - lawyers who are founders of the lawyer's office.

- 770 is an individual entrepreneur who is the head of a peasant farm.

7. "OKATO Code". We have already spoken about it above. To learn it is also quite easy. He is also posted on the information stands in the tax inspection department.

8. Next are the fields for entering personal information about the taxpayer: name, contact phone.

I.Then the first page of the title page is divided into two columns. You need only fill the left side. If the documents are provided personally by the taxpayer, then we put the number "1" up in the column. If the trustee does this, then you must write down the full name of the representative and the name of the authorizing document below.

10. Now go to page 2 of the title page. Personal data are also entered here: address, series and passport number, when issued and issued by someone. Pay attention to several codes:

- Presence of citizenship - citizens of the Russian Federation put the figure "1", persons without citizenship - "2".

- Country code is put "643"

- The document code is "21", because in the absolute majority of cases it is the passport that is required.

- "Taxpayer status" - residents put a unit, non-residents - a deuce.

In the age of information technology is much easieruse specialized software. There are several programs at the moment, but the most accessible and easy to use is the "Declaration 20__" PP. For each year you need to install a separate version. Officially and free of charge, it is distributed through the official website of the Federal Tax Service, so that for citizens could not imagine the declaration of 3-NDFL. How to fill in the program "Declaration 2013", we now analyze for an example. When you open the program, we see the "Defining conditions" window. It is here that you need to put all the values mentioned above.

To enter your personal informationtaxpayer, you need to click the button "Information on the declarant". Note that in this window there are two tabs: passport data and information about the place of residence. Their icons are located above the "Name" block. You need to fill both.

On this title page is considered completed. Then you can go to the main sections. It is impossible to consider all cases of filling out the declaration within the framework of one article, therefore, we will dwell on the most frequently encountered ones.

Sale of property

After entering your personal information, go to the button"Incomes received in the Russian Federation". Here we see three tabs: "13", "9", "35". We are interested in the first one. with income from the sale of property will have to pay 13%. This should reflect the declaration of 3-NDFL. How to fill in when selling a car? To do this, in the open tab "13" in the top field you need to click on the plus sign. The "Payment Source" window opens. In the field "Name of the source of payment" you can write: "Sale of the machine." The remaining fields are left free. The system will issue a warning that the OCTMO code is not full. In this case, you can skip it. Further we descend into the lower field and click on the plus sign already there. The "Income received" window opens. To start, you need to select an income code. To sell the car is the "1520". Next, make the sale amount. And pay attention to the item "Deduction code". It is needed in order to reduce the amount of tax. So, if the car was in the property less than three years, you can reduce the taxable base by 250,000 rubles or the cost of the car when you buy. The corresponding amount should be entered in the field "Amount of deduction (expense)", of course, it should not exceed the income from the sale. Next, you need to calculate the tax base and the tax itself and enter the data in the total sums section. Thus, the declaration of 3-NDFL is filled. How to fill in when selling an apartment? Actually, exactly the same. Only the income code will be "1510" or "1511", depending on whether you completely owned the apartment or only part of it. And the deduction, of course, will be different. It is worth noting that in this section it is necessary to make all the incomes received in the reporting year, except wages, if the purpose of the declaration is not to receive social or property deduction.

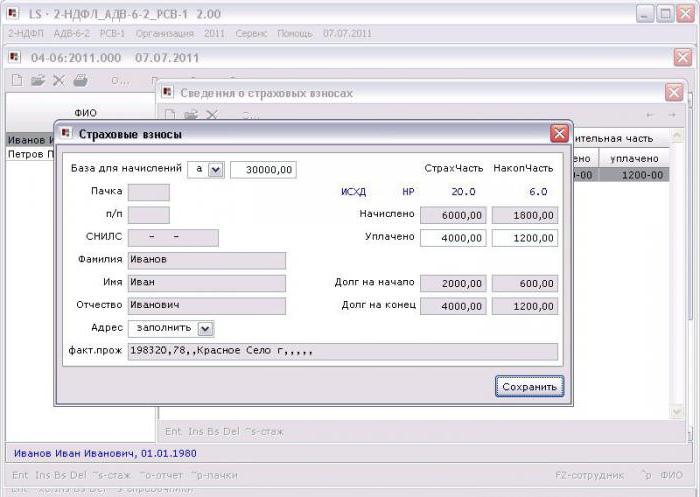

Social deduction

Often we are faced with the fact that we need to returnpaid tax in the case of training, pension insurance or treatment. In this case, you will also need a declaration of 3-NDFL. How to fill in for 2013 for treatment or training? Here we need a certificate of 2-NDFL, obtained at work. It is necessary to fill in the income data. The principle is the same as described above. But all codes and amounts are taken from the help. The income is prescribed in this program for each month separately. If the employer applied standard deductions, you need to tick the box. Next, click on the "Deductions" button. We have a tab for standard deductions. Data are also included here from the 2-NDFL certificate. Now we need a social deductions tab to get a 3-NDFL declaration. How to fill in the year 2013 for dental treatment, for example? It is enough to enter the total amount in the field "Treatment" or "Expensive treatment" - depending on the category of services rendered to you. Similarly, the declaration is filled in the case of training on a fee basis.

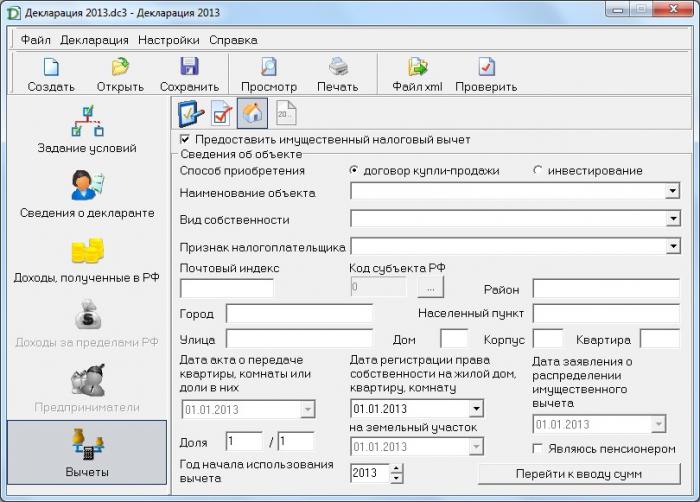

Buying a home

When buying a home is also useful declaration3-NDFL. How to fill in the property deduction for 2013, now we'll see. All that concerns the title page, income, standard deductions, remains unchanged. But now we need an additional tab - "Property deduction". All data is entered here from the available documents: a sales contract, a certificate of registration, a loan agreement. When the information on the acquired property is filled, you must click on the button "Go to the input of amounts". If this type of declaration is not for the first time, you may need data from previous years. They can be found either from the tax inspector, or from the previous 3-NDFL.

What we will receive after filling

When all the data is included in the program, you need toClick the "Save" button and select the storage location. After that you can preview what happened by applying the corresponding button. And after - print. At any time, you can correct the data if you find an error. The program itself will calculate the amount of tax payable or refundable and complete the resulting sections. Print only those sheets that are needed. You will only have to sign, date and submit documents to the tax authority.

Afterword

In conclusion, I want to advise you not to be afraidsuch document as the declaration of 3-NDFL. How to fill in for 2013, we considered for an example. Other reporting periods are not much different. In any case, it's quite easy to handle this software, the main thing is to pay close attention to this case. Then your documents will be filled correctly.